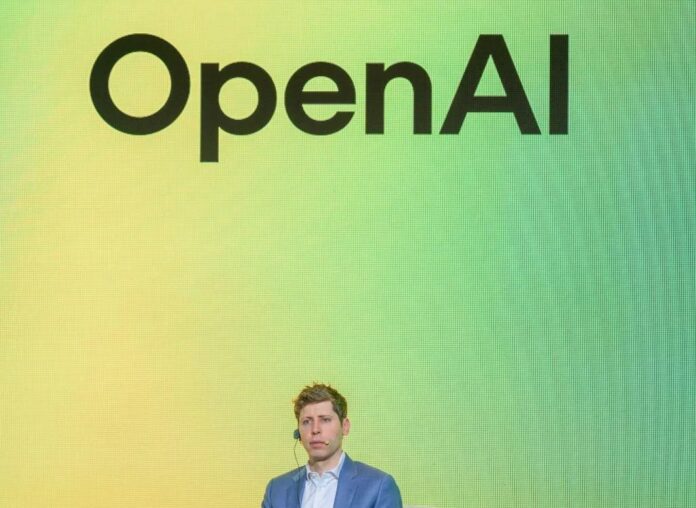

OpenAI is solidifying its influence over the AI landscape through a strategic investment in Thrive Holdings, a private equity firm focused on integrating AI into various sectors. The move is part of a growing trend where OpenAI isn’t just selling AI tools but also actively shaping the businesses that use them – and profiting from their success.

Circular Investment Strategy

The deal involves OpenAI taking an ownership stake in Thrive Holdings, whose parent company, Thrive Capital, is a significant investor in OpenAI itself. This creates a circular relationship: OpenAI benefits as Thrive’s portfolio companies grow using OpenAI’s technology, and Thrive benefits from OpenAI’s expertise and direct involvement.

Specifically, OpenAI will embed its engineers, researchers, and product specialists within Thrive’s portfolio companies to accelerate AI adoption and drive efficiency. When these companies succeed, OpenAI’s stake increases, and it receives compensation for its services. This is not the first time OpenAI has followed this pattern. It recently invested $350 million into CoreWeave, a compute infrastructure provider that then purchased Nvidia chips – the same chips OpenAI uses for its own operations. The result is a self-reinforcing system where OpenAI’s growth fuels its partners, and vice versa.

Why This Matters

This type of investment is significant because it illustrates OpenAI’s evolving strategy. It’s no longer just an AI developer but an ecosystem architect, actively influencing the growth of companies dependent on its technology. This raises questions about fair competition and long-term sustainability. If success relies heavily on OpenAI’s direct involvement, can these Thrive-owned businesses truly stand on their own?

Thrive Holdings defends the deal, stating it’s responding to market demand. Portfolio companies like Crete (accounting) and Shield (IT services) have reportedly already seen efficiency gains with AI tools. However, outside observers question whether these successes are organic or artificially inflated by OpenAI’s embedded support.

The Big Picture

The core issue is transparency. The overlapping ownership makes it difficult to gauge whether Thrive’s portfolio firms will build sustainable profitability or merely see inflated valuations based on OpenAI’s involvement. Analysts will closely watch whether these companies can prove long-term viability independent of OpenAI’s direct support.

“The embedded nature of OpenAI’s involvement makes it hard to assess whether success comes from genuine market traction or from advantages that won’t scale without OpenAI’s direct backing.”

This deal is a test case for how AI giants will shape the future of their industry. It highlights a trend where AI providers are not just selling tools but also becoming stakeholders in the businesses that rely on them, blurring the lines between technology vendor and strategic partner.